Plan ahead and trade on your terms

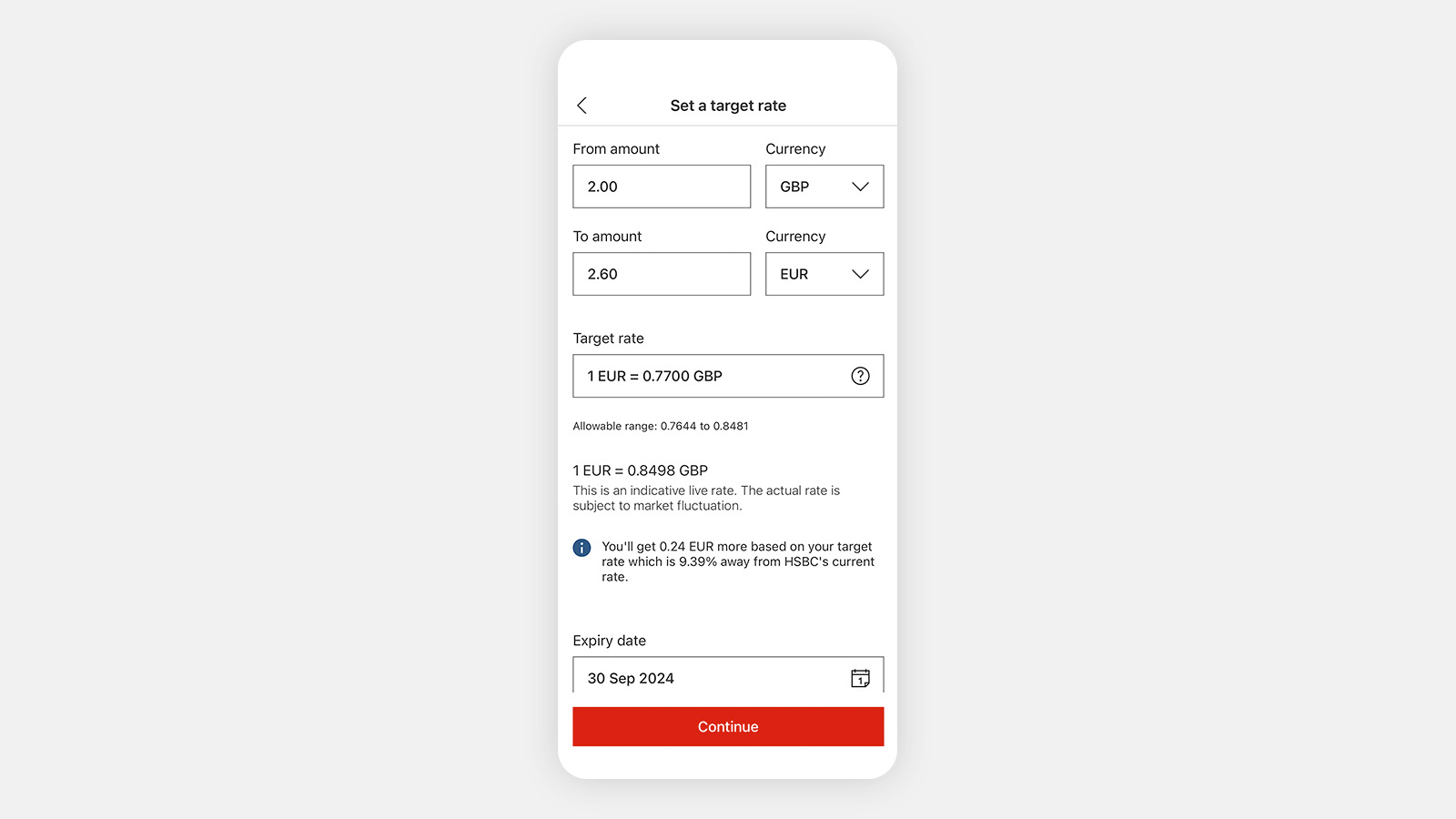

If you don't want to settle for the current exchange rate and you don't need your currency right away, a limit order might help you get more for your money.

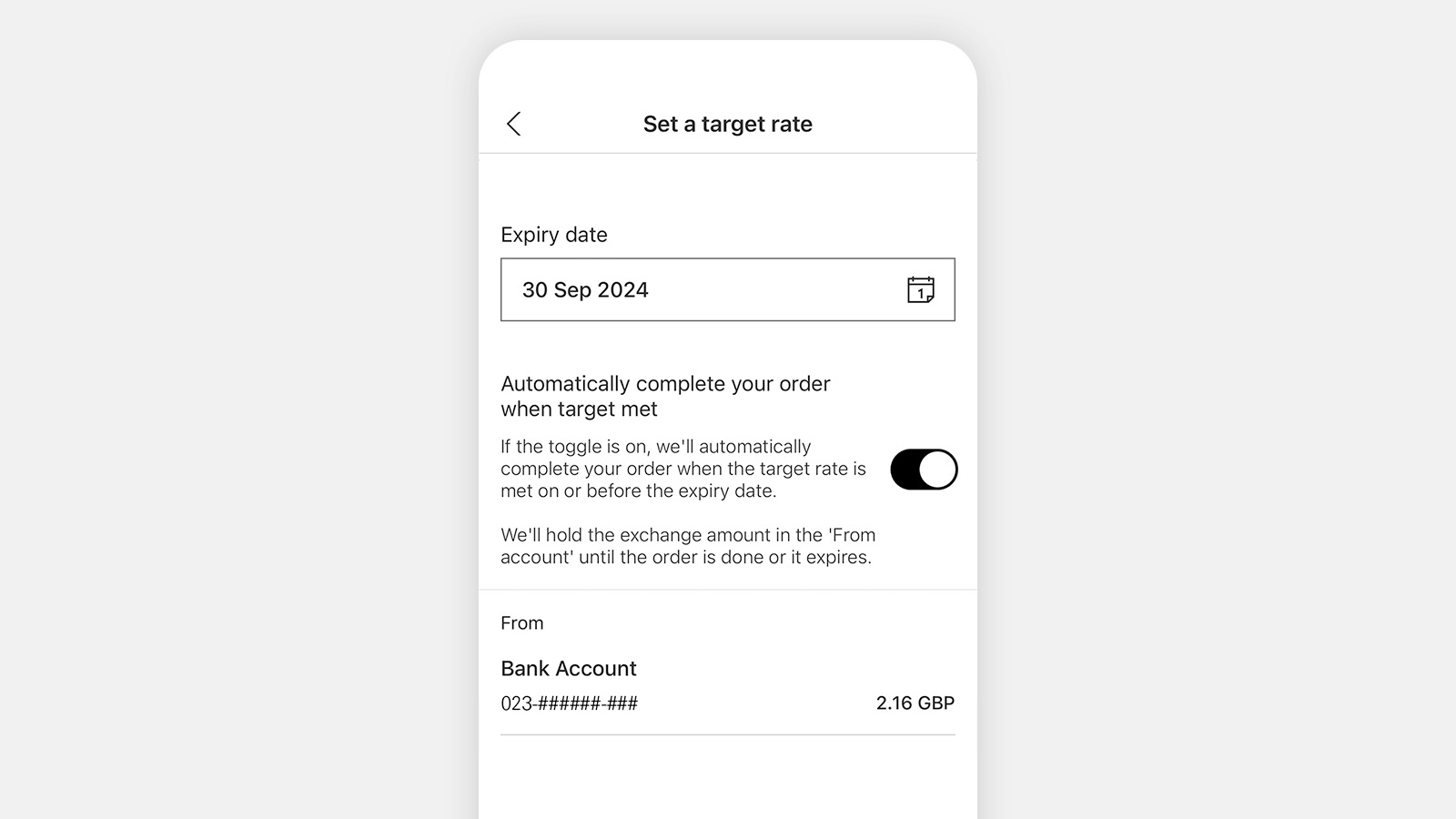

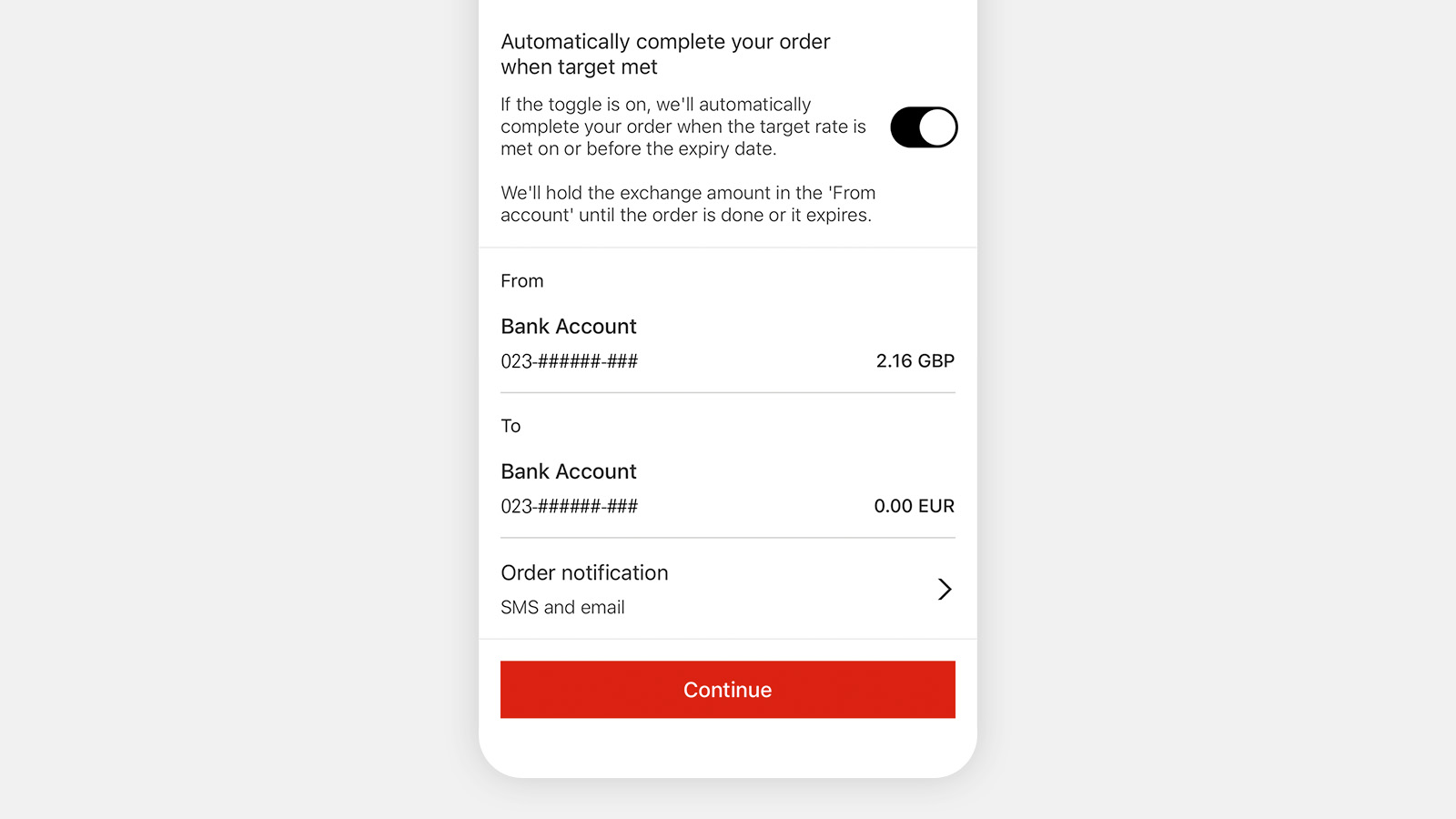

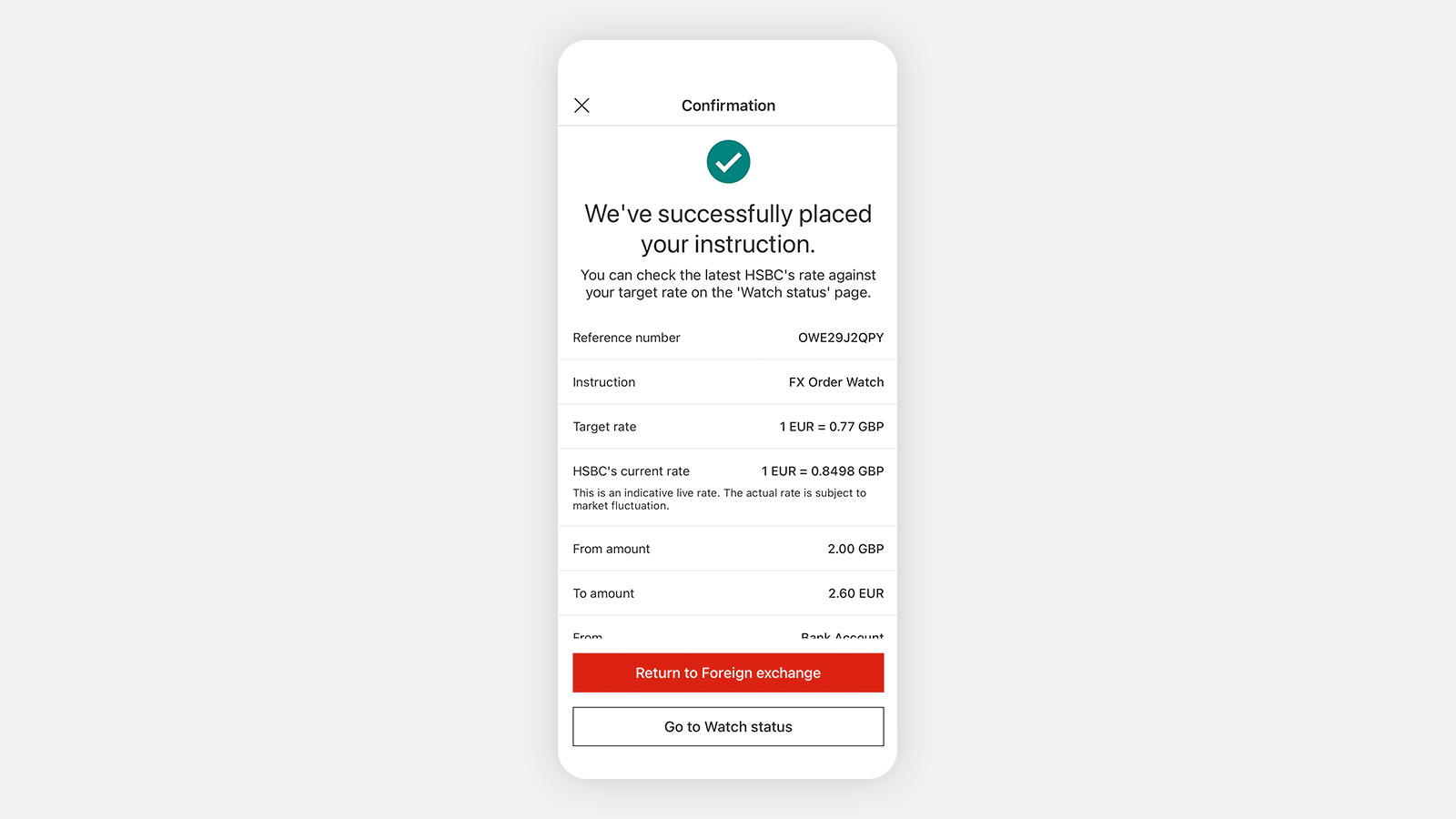

You set the rate at which you'd like to exchange, and if that rate becomes available, the exchange will go through automatically. You won't need to monitor the market and you won’t miss out, even if things change quickly.

How to place a limit order

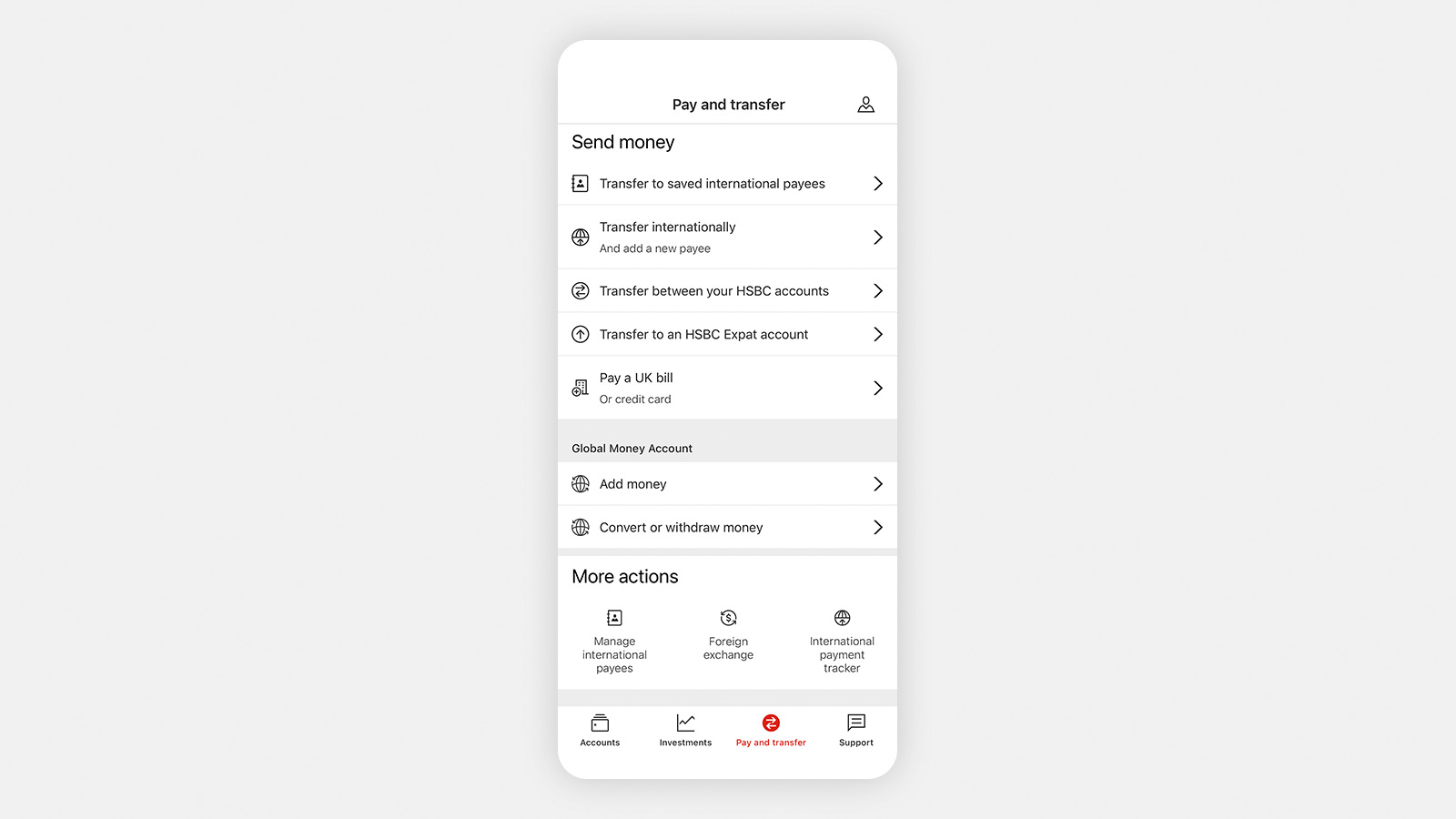

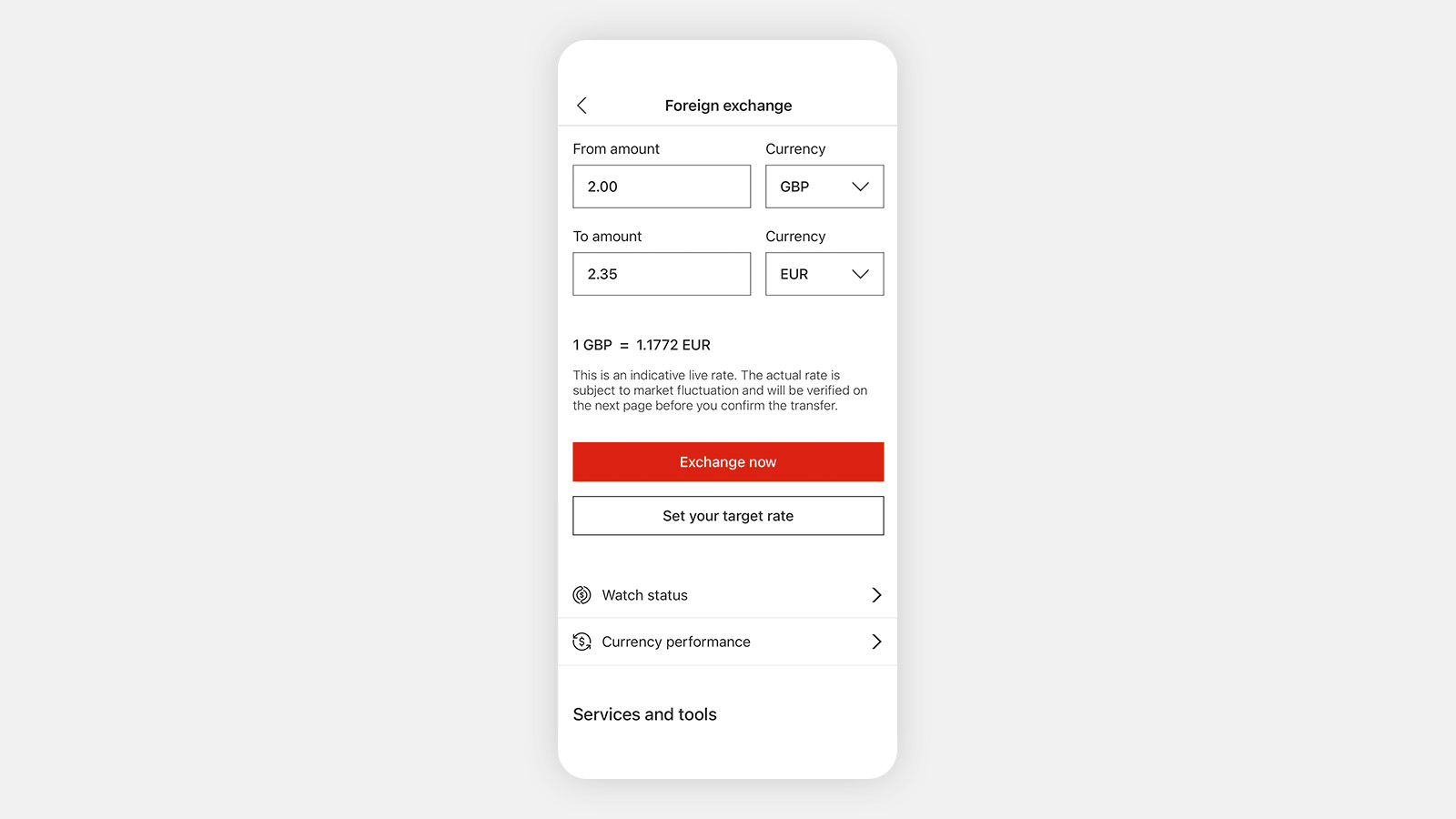

You can place a limit order using the HSBC Expat Mobile Banking app or through your relationship manager.

To place a limit order in the app, log on and follow these steps:

Download the app

Place a limit order on your mobile

Scan the QR code or tap the 'Get the app' button to download the HSBC Expat Mobile Banking app.

You might also be interested in

With a limit order in place, you won't need to monitor the market - you can sit back and wait for the trade to happen.

From simple currency transactions to complex international financial management, FX services help you capitalise on our global expertise.

HSBC accounts around the world? We've made moving money between them simple with our Global View and Global Transfer services.