Choose your risk level

Our World Selection investment portfolios offer peace of mind that your investments will be professionally monitored by our team of qualified investment professionals to ensure they stay at the risk level you've chosen.

Why invest in HSBC World Selection Portfolios

Setting up your portfolio

Choose from 5 portfolios designed to suit your level of risk.

Your investments will then be monitored by our team of qualified investment professionals to ensure they stay at the risk level you've chosen. You can diversify your portfolio across different products and currencies.

This product is offered online without advice. This means we aren't required to assess the suitability of this product for you if you choose to invest online. However, you can also invest through our financial planning service.

How it works

1. Log on

Log on to the HSBC Expat Mobile Banking app to get started.

2. Go to Investments

Go to the 'Investments' tab from your 'Accounts' homepage.

3. Start buying and selling

Invest and manage your portfolio 24/7 with mobile or online banking.

Our portfolios

Our portfolios will mostly invest in or gain exposure to fixed income securities, company shares and alternatives including real estate, private equity and commodities. Choose the risk level that's right for you.

The charts show a strategic breakdown only, meaning the percentages shown may vary slightly. For the current breakdown please see the corresponding factsheet.

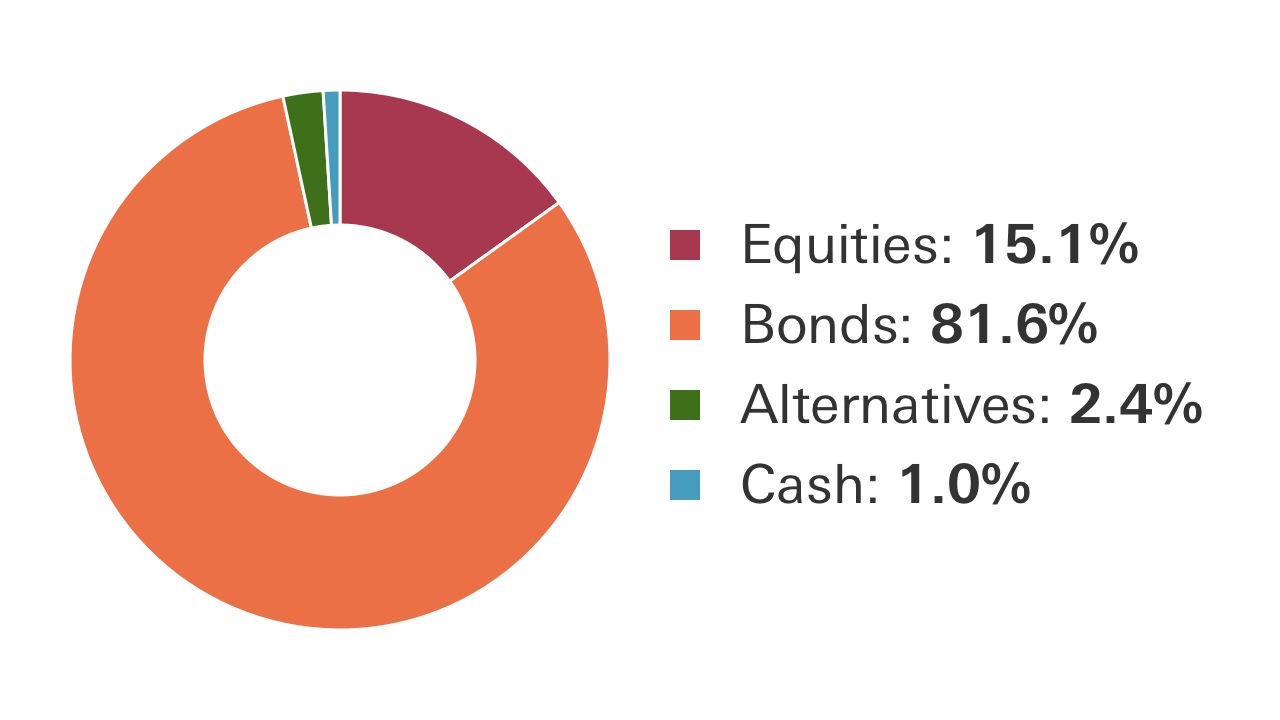

Low risk portfolio

World Selection 1

Typically, the fund will have a significant bias towards investments with fixed interest strategies, with a maximum of 25% investment in or exposure to company shares.[@world-selection-risk-level-1]

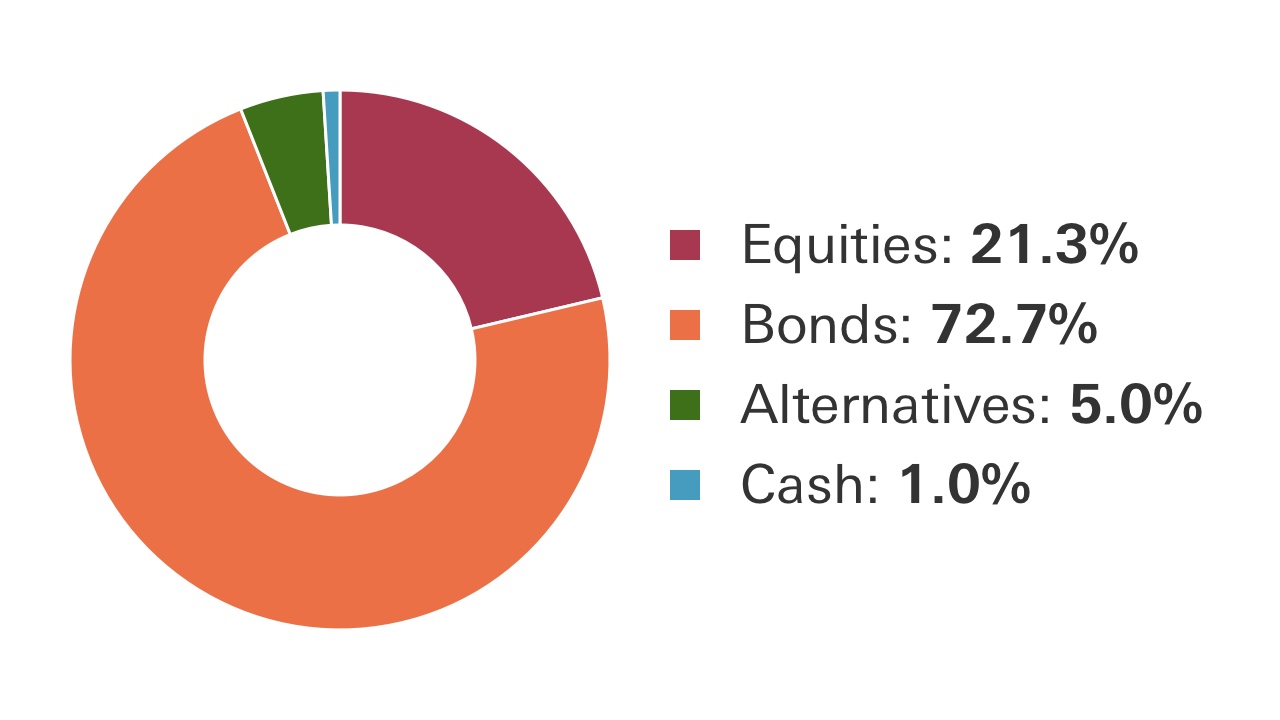

Low to medium risk portfolio

World Selection 2

Typically, the fund will have a bias towards investments with fixed interest strategies, but may have up to 50% investment in or exposure to company shares and up to 25% exposure in alternatives.[@world-selection-risk-level-2]

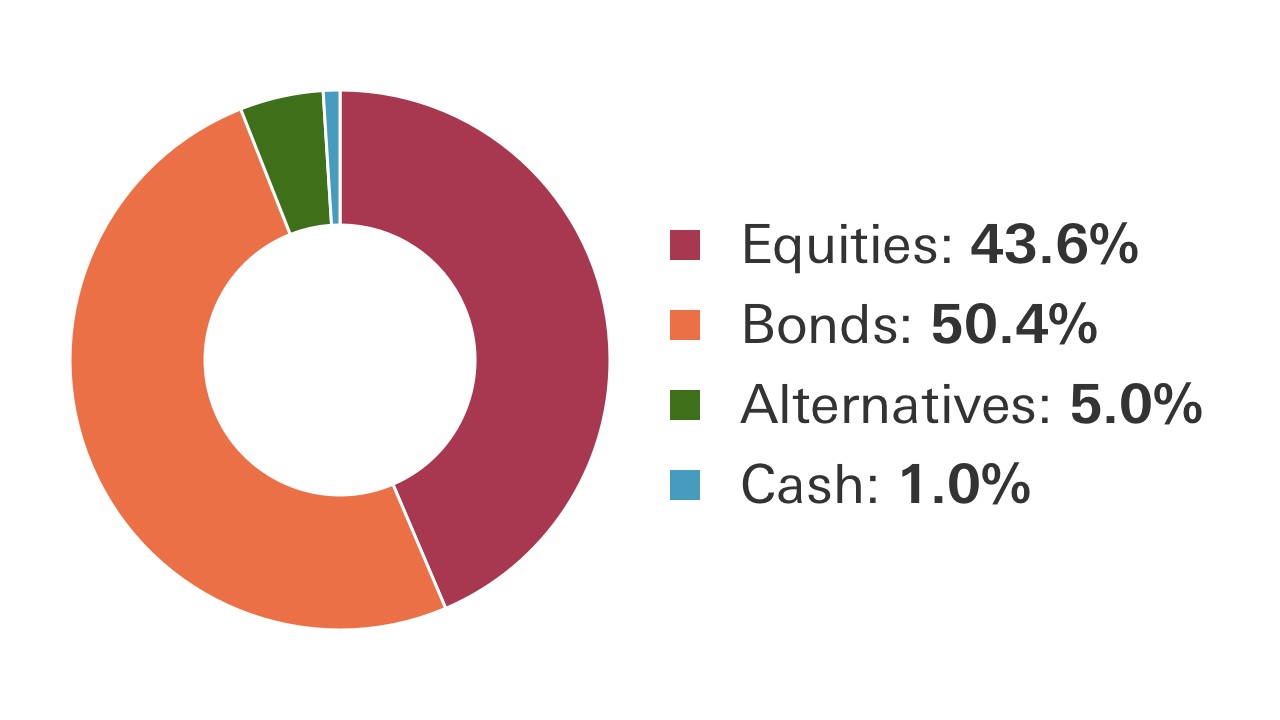

Medium risk portfolio

World Selection 3

The portfolio will hold at least 70% fixed income securities and company shares, and may gain exposure of up to 30% in alternatives.[@world-selection-risk-level-3]

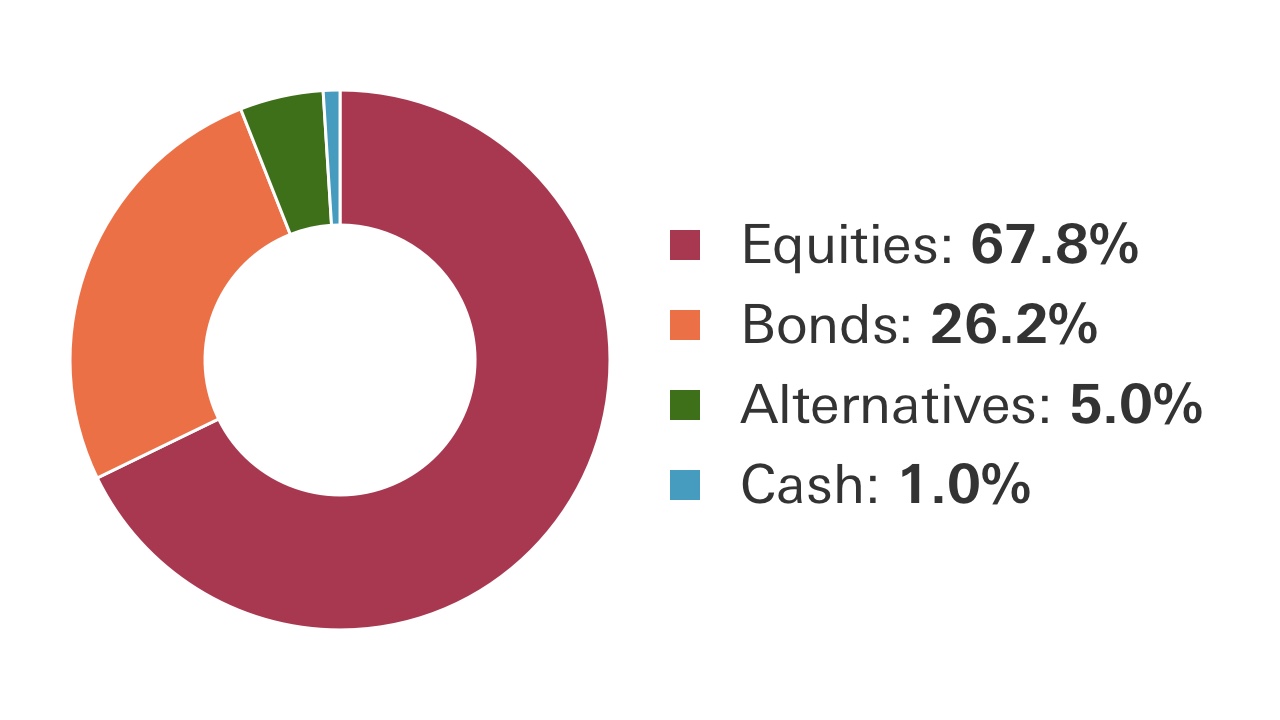

Medium to high risk portfolio

World Selection 4

The portfolio will hold at least 65% fixed income securities and company shares, and may gain exposure of up to 35% in alternatives.[@world-selection-risk-level-4]

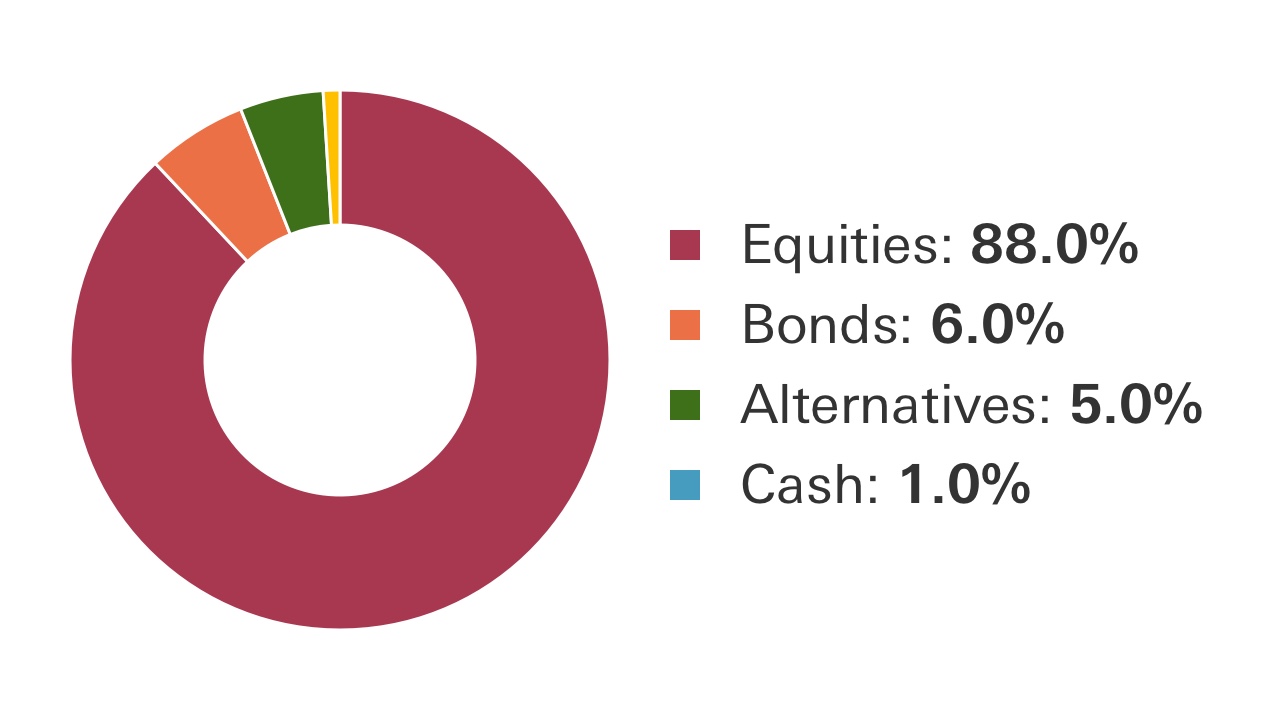

High risk portfolio

World Selection 5

The portfolio will hold at least 55% fixed income securities and company shares with a bias towards shares, and may gain exposure of up to 45% in alternatives.[@world-selection-risk-level-5]

Things to know

Who can apply?

You can invest in portfolio investment funds if you're:

- an existing HSBC Expat customer and registered for online banking

- aged 18 or over

- want to make your own investment decisions and looking to invest:

- GBP/USD/EUR 100 per month with a minimum GBP/USD/EUR 100 invested in any one portfolio

- or an initial lump sum of GBP/USD/EUR 1,000 in any one portfolio

- a resident and/or national of an eligible country or region

If you are receiving advice, you need to have a minimum investment of GBP 25,000 in one product or a combination of products.

Ready to apply?

| Already with Expat? |

For the quickest way to invest, go to the International Investment Centre in our mobile banking app.

| If you're viewing this page on a computer, scan the QR code with your phone to download the app or get started. |

New to Expat?

You can apply for HSBC World Selection Portfolios once you have opened an HSBC Expat Bank Account with us. |

Other ways to apply

Frequently asked questions

You might be interested in

Invest online today

Whether you're a seasoned investor or just starting out, you can buy, sell and explore investments in our International Investment Centre. Available in the app 24/7.

Financial terms

New to investing? Understand the key investment terms to know before you get started.

Get financial advice

Need a helping hand? Our experts can help you find the right investment solutions to match your goals.