4 November 2024

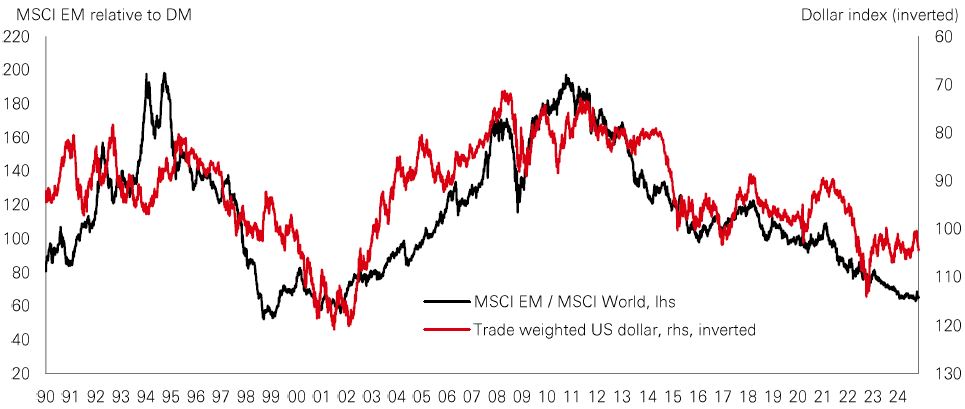

The recent strengthening of the US dollar (USD) has put emerging market assets under pressure. Will it continue?

The stronger dollar and rising US Treasury yields have been driven by a string of better-than-expected US economic data. The moves also reflect investor uncertainty about how the US policy agenda might impact fiscal deficits and inflation trends. New industrial policies, for example, could leave the Fed with less room to cut rates, boosting the USD further.

However, the dollar outlook isn’t straightforward. The BRICS summit highlighted an ongoing trend for de-dollarisation; the reduced use of the USD in world trade and financial transactions. It’s notable that in emerging market FX reserves, the dollar is becoming less dominant. But this process is very gradual and seems likely to take decades.

Back to today, the central scenario is one of ongoing disinflation, Fed cuts, and softer US growth. And these forces are consistent with lower US bond yields and a weaker USD.

Three things about the capital markets stand out. First, a medium-term economic regime of more volatile inflation and a new fiscal/monetary policy mix raises the assumption for interest rates. And that reinforces the appeal of core fixed income and the ‘all-in’ yields from ‘senior’ credit asset classes like infrastructure debt, asset-backed securities, and global investment grade.

Second, the most compelling valuation anomaly today is in emerging markets. EM fixed income and equity returns look higher than in most of the G7. Opportunities in India, North Asia, and frontier markets stand out, as do themes in local currency EM bonds.

Third, as the economic environment becomes more uncertain, there needs to be a larger role for private markets and other alternatives. That means focusing on diversifiers like hedge funds or commodities, the double-digit yields in private credit and infrastructure equity, and the emerging value in real estate and private equity.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Past performance does not predict future returns. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. Any views expressed were held at the time of preparation and are subject to change without notice. Diversification does not ensure a profit or protect against loss.

Source: HSBC Asset Management. Macrobond, Bloomberg. Data as at 7.30am UK time 04 November 2024.

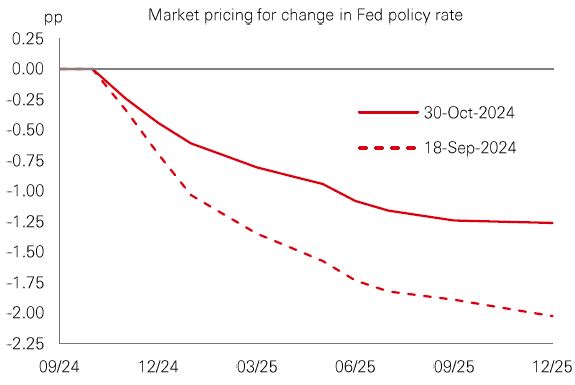

The Fed’s November meeting will take place after the US elections. While the election could bring with it some market volatility, the Fed is likely to look through this and focus on the recent data.

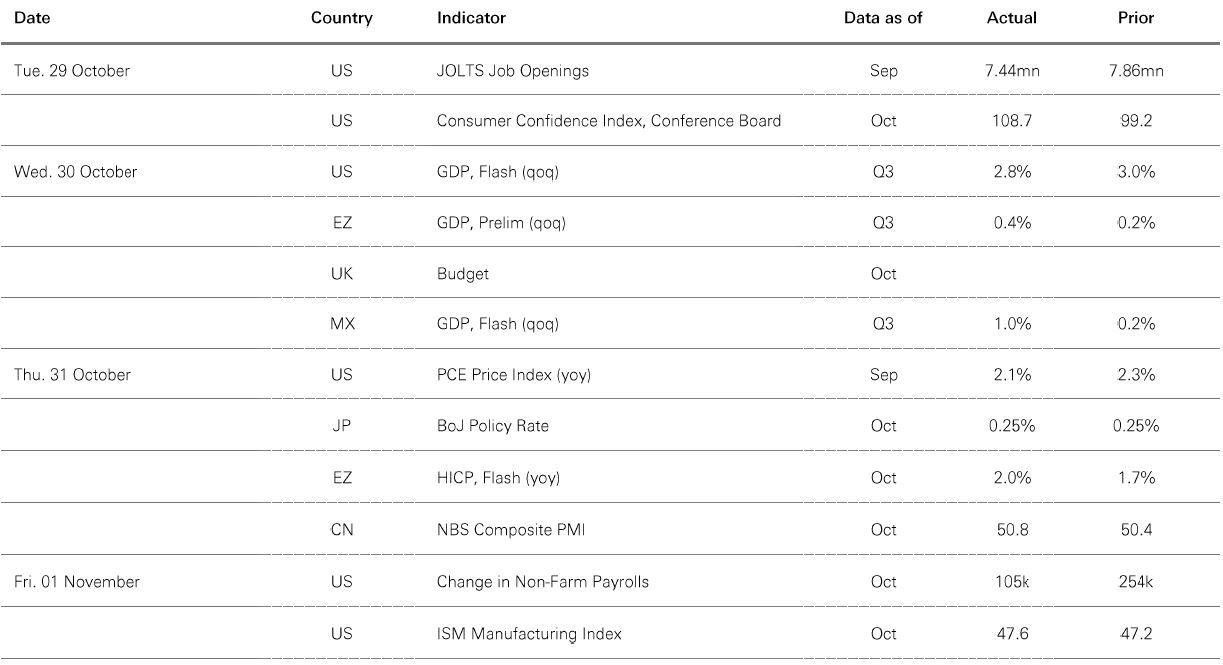

On that front, it is in a more comfortable position than in September, when it opted to cut rates by 0.5%. On average, activity data have surprised to the upside, after a run of softer readings over the summer. Labour data have been mixed – employment measures have remained robust, despite depressed new hiring and layoffs picking up in September. Overall, the Fed is likely to be relaxed about growth and labour developments. And while core PCE inflation picked up on a month-on-month basis in September, the six-month annualised pace of change – something Powell has mentioned the Fed looks at – is running only marginally above target, at 2.3%.

We see a 0.25% cut being delivered this month, which is in line with market pricing. To maximise the chances of a soft landing, the Fed is expected to opt for a further steady stream of cuts at subsequent meetings to bring the funds rate down to a more ‘neutral’ level by mid-2025.

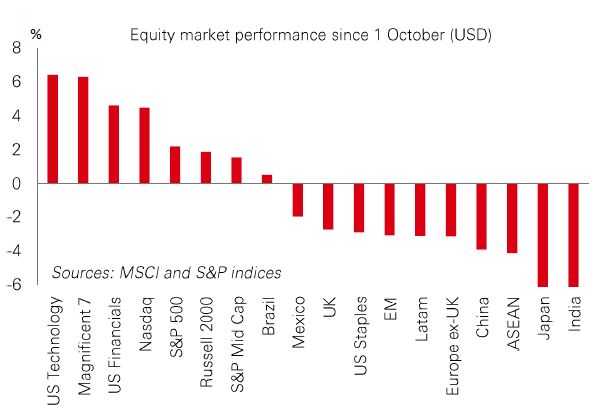

Against a backdrop of decent Q3 earnings and resilient macro data, investors turned even more bullish on US stocks in October. Demand for volatility protection – as measured by the put-to-call ratio – is below average. ‘Bulls’ still outweigh ‘bears’ in the AAII investor sentiment survey, and defensive sectors like Staples have lagged.

Faced with uncertainty over potential economic policy changes in the months ahead, investors have so far opted for the perceived safety of US stocks. Emerging market equities have been weaker, notably in India, ASEAN, and China. Eurozone stocks have also been out of favour.

Amid some reasonable Q3 earnings reports from Magnificent 7 stocks last week, US technology remains in demand – despite average price-to-book valuations at an all-time high of 23x and high overseas exposure, with 60% of sector sales going abroad. But Financials and even US small-caps have outperformed versus the rest of the world. Yet, US stocks could be vulnerable to a shift in mood once the details of any changes to US trade policies are clearer.

Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. Any views expressed were held at the time of preparation and are subject to change without notice.

Source: HSBC Asset Management. Macrobond, Bloomberg, Datastream. Data as at 7.30am UK time 04 November 2024.

Source: HSBC Asset Management. Data as at 7.30am UK time 04 November 2024. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. Any views expressed were held at the time of preparation and are subject to change without notice.

Risk markets are on the defensive ahead of the US presidential election, with the US DXY dollar index consolidating after recent gains. Core government bonds weakened on upward US and Eurozone data surprises. Gilts lagged US Treasuries as investors fretted about the medium-term outlook for government borrowing, led by a rise in 2-year yields. In the US, the Nasdaq fell on disappointing outlooks from some tech heavyweights. Weaker tech stocks pressured the Euro Stoxx index. The Nikkei 225 pared most of its gains amid a firmer yen following hawkish comments from BoJ Governor Ueda. In EM, the Shanghai Composite Index and Hang Seng slipped ahead of the key National People’s Congress Standing Committee meeting. India’s Sensex index traded sideways. In commodities, easing geopolitical tensions pushed down oil prices. Gold prices reached a new high.

This document has been issued by The Hongkong and Shanghai Banking Corporation Limited (the "Bank") in the conduct of its regulated business in Hong Kong and may be distributed in other jurisdictions where its distribution is lawful. It is not intended for anyone other than the recipient. The contents of this document may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose. This document must not be distributed to the United States, Canada or Australia or to any other jurisdiction where its distribution is unlawful. All non-authorised reproduction or use of this document will be the responsibility of the user and may lead to legal proceedings.

This document has no contractual value and is not and should not be construed as an offer or the solicitation of an offer or a recommendation for the purchase or sale of any investment or subscribe for, or to participate in, any services. The Bank is not recommending or soliciting any action based on it.

The information stated and/or opinion(s) expressed in this document are provided by HSBC Global Asset Management Limited. We do not undertake any obligation to issue any further publications to you or update the contents of this document and such contents are subject to changes at any time without notice. They are expressed solely as general market information and/or commentary for general information purposes only and do not constitute investment advice or recommendation to buy or sell investments or guarantee of returns. The Bank has not been involved in the preparation of such information and opinion. The Bank makes no guarantee, representation or warranty and accepts no responsibility for the accuracy and/or completeness of the information and/or opinions contained in this document, including any third party information obtained from sources it believes to be reliable but which has not been independently verified. In no event will the Bank or HSBC Group be liable for any damages, losses or liabilities including without limitation, direct or indirect, special, incidental, consequential damages, losses or liabilities, in connection with your use of this document or your reliance on or use or inability to use the information contained in this document.

In case you have individual portfolios managed by HSBC Global Asset Management Limited, the views expressed in this document may not necessarily indicate current portfolios' composition. Individual portfolios managed by HSBC Global Asset Management Limited primarily reflect individual clients' objectives, risk preferences, time horizon, and market liquidity.

The information contained within this document has not been reviewed in the light of your personal circumstances. Please note that this information is neither intended to aid in decision making for legal, financial or other consulting questions, nor should it be the basis of any investment or other decisions. You should carefully consider whether any investment views and investment products are appropriate in view of your investment experience, objectives, financial resources and relevant circumstances. The investment decision is yours but you should not invest in any product unless the intermediary who sells it to you has explained to you that the product is suitable for you having regard to your financial situation, investment experience and investment objectives. The relevant product offering documents should be read for further details.

Some of the statements contained in this document may be considered forward-looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Such statements do not represent any one investment and are used for illustration purpose only. Customers are reminded that there can be no assurance that economic conditions described herein will remain in the future. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. We can give no assurance that those expectations reflected in those forward-looking statements will prove to have been correct or come to fruition, and you are cautioned not to place undue reliance on such statements. We do not undertake any obligation to update the forward-looking statements contained herein, whether as a result of new information, future events or otherwise, or to update the reasons why actual results could differ from those projected in the forward-looking statements.

Investment involves risk. It is important to note that the capital value of investments and the income from them may go down as well as up and may become valueless and investors may not get back the amount originally invested. Past performance contained in this document is not a reliable indicator of future performance whilst any forecasts, projections and simulations contained herein should not be relied upon as an indication of future results. Past performance information may be out of date. For up-to-date information, please contact your Relationship Manager.

Investment in any market may be extremely volatile and subject to sudden fluctuations of varying magnitude due to a wide range of direct and indirect influences. Such characteristics can lead to considerable losses being incurred by those exposed to such markets. If an investment is withdrawn or terminated early, it may not return the full amount invested. In addition to the normal risks associated with investing, international investments may involve risk of capital loss from unfavourable fluctuations in currency values, from differences in generally accepted accounting principles or from economic or political instability in certain jurisdictions. Narrowly focused investments and smaller companies typically exhibit higher volatility. There is no guarantee of positive trading performance. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. Economies in emerging markets generally are heavily dependent upon international trade and, accordingly, have been and may continue to be affected adversely by trade barriers, exchange controls, managed adjustments in relative currency values and other protectionist measures imposed or negotiated by the countries with which they trade. These economies also have been and may continue to be affected adversely by economic conditions in the countries in which they trade. Mutual fund investments are subject to market risks. You should read all scheme related documents carefully.

Copyright © The Hongkong and Shanghai Banking Corporation Limited 2024. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of The Hongkong and Shanghai Banking Corporation Limited.

Issued by The Hongkong and Shanghai Banking Corporation Limited