Affluent Investor Snapshot 2024[@affluent-investor-snapshot-2024]

We surveyed over 11,000 affluent individuals across 11 markets and asked some simple yet important questions about investment behaviours worldwide.

Why should I invest, especially now?

Is cash still king?

By Fan Cheuk Wan

Chief Investment Officer, Asia

HSBC Global Private Banking and Wealth

In the realm of investment, holding excessive idle cash represents a missed opportunity. Cash cannot harness the full potential of returns, leaving your long-term goals unmet. Moreover, because the value of cash depreciates over time, it fails to shield wealth from inflation. Nevertheless, many investors continue to allocate a significant portion of their portfolio to cash.

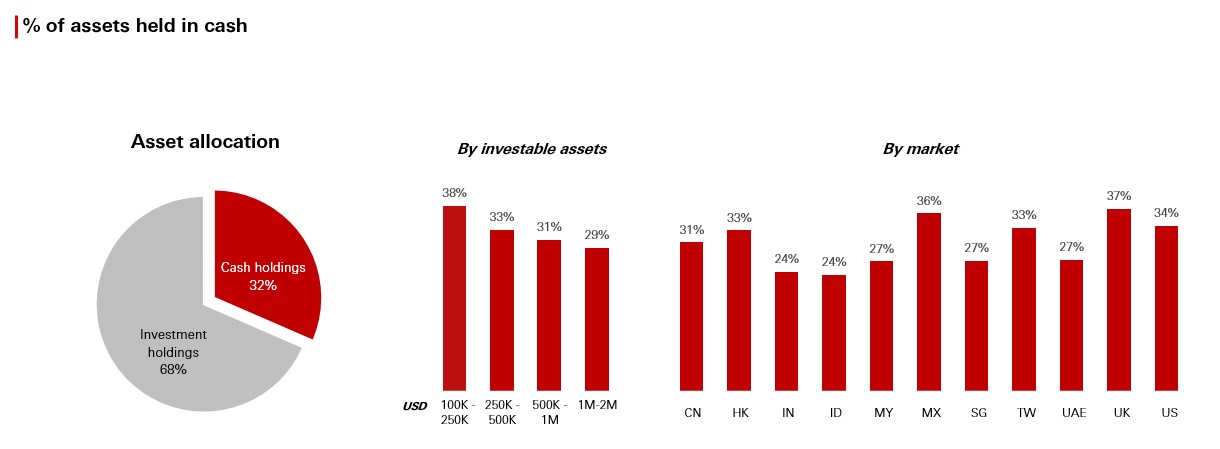

Cash holdings dominate affluent investors’ portfolios, ranging from 24% in India and Indonesia to 37% in the UK.

According to our latest Affluent Investor Snapshot 2024, 39% of affluent investors plan to adjust their asset allocations, while the remaining 61% don’t plan to make any changes or have yet to decide to reassess their portfolios over the next year, potentially leaving them with a much larger allocation to cash. This entails risks.

Our analysis of investment returns over the past century reveals that cash is not the optimal strategy for long-term wealth creation. Historical data suggests that equities, bonds, real estate and certain alternatives such as private assets and hedge funds have consistently delivered higher returns than cash over the long term. We project that cash will yield an average return of 2.8% over the next decade, significantly underperforming compared to the expected return of 8% for developed market equities and a foreseeable 5.4% return of global investment-grade corporate bonds.

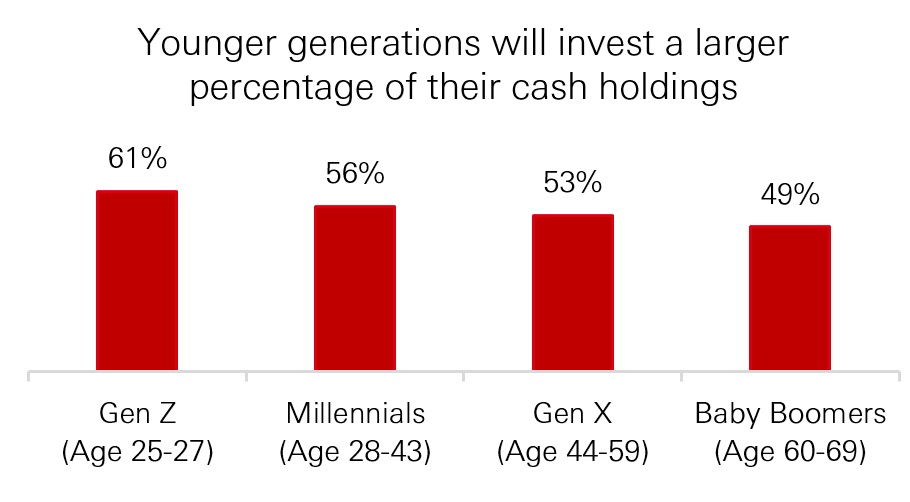

39% of the affluent investors who intend to change their portfolio allocations will invest more than half (54%) of the cash they’re holding.

What should I do with my cash?

In the next 6-12 months, investors can consider putting excess cash to work in a core allocation to bonds and equities in diversified portfolios. This can help generate a stable income stream and capital appreciation, while also providing portfolio diversification benefits. We expect that cash returns will start to come down later this year, since rate cuts are just a matter of time. Therefore, investors can adopt a smart approach by allocating their cash to bonds and multi-asset strategies now, while focusing on locking in attractive bond yields, which are near decade-high levels.

The improving global economic outlook supports our pro-risk investment strategy with overweight allocation to global equities and bonds for the next 6 months. The cyclical improvement should help profit growth spread beyond technology to other sectors, as illustrated by the strong US Q1 earnings season.

We see numerous opportunities in equities and bonds

Equities: US, Mexico, India, Japan, South Korea

Bonds: US Treasuries, UK gilts, investment grade bonds and Indian local currency bonds

The trade-off: liquidity vs. returns

For investors who prefer to maintain higher liquidity in their portfolios and who are willing to accept a certain credit risk, short duration bonds should offer an attractive alternative to cash holding in generating a stable income stream. Short duration bonds are liquid fixed income securities with relatively short maturities from six months to three years. Bonds with shorter durations are less sensitive to interest rate volatility and are therefore less volatile in an uncertain rate environment.

Yields on short duration credit are now standing at near decade-high levels too, offering investors a defensive opportunity to capture income at low risk. Furthermore, cash flows from frequently maturing short-dated bonds can provide better liquidity than longer duration bonds and they generally carry less uncertainty because the principal is repaid more quickly and can be reinvested earlier.

Unlike cash, short duration strategies are not entirely risk-free, but they offer an intermediate step out of cash into risk assets for a more cautious approach to seeking capital gain and higher income versus time on deposit. Historically, short duration bonds have generated lower total returns than other riskier asset classes, but they also court less volatility than other assets except for cash. In a rate-cutting cycle, short-dated bonds may be reinvested at lower yields.

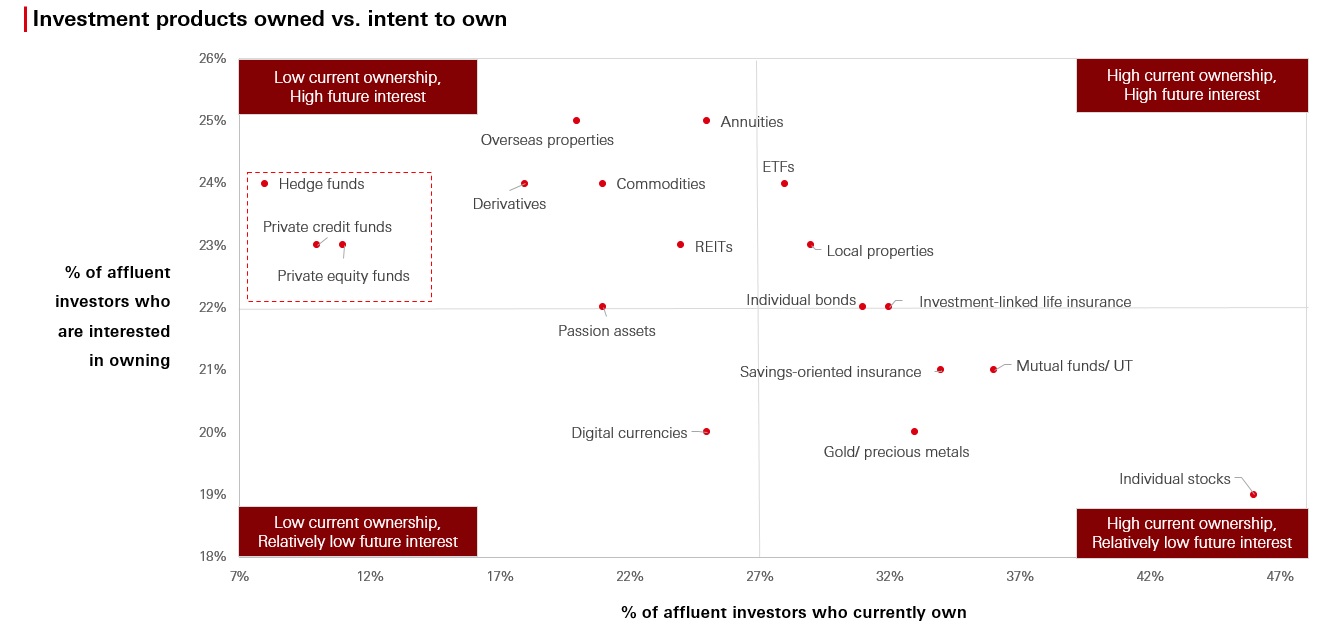

Stepping beyond tradition

There’s relatively high interest in investing in alternatives asset classes such as hedge funds, private credit funds and private equity, etc.

Markets will continue to worry about cyclical, interest rate and geopolitical risks. Ongoing geopolitical tensions and the unpredictable outcome of the US elections in November are wild cards fuelling volatility in the energy, commodity and currency markets. We think a strategic allocation to alternative investments as a core holding should add protection to portfolios and lower volatility via multi-asset risk diversification.

Alternatives asset classes including hedge funds, private equity, private credit funds, real estate and commodities have a lower correlation to traditional asset classes like stocks and bonds. Alternatives have proved to be effective portfolio building blocks in diversifying portfolio risks and enhancing portfolio resilience against market uncertainty.

For investors who look for lower entry thresholds and easier access to alternatives investment, multi-asset funds with core allocation to alternatives can provide convenient investment tools to build strategic exposure to alternatives. Multi-asset funds with allocation to alternatives can help improve the risk-return profile of portfolios by enhancing total returns through the access they provide to a broader universe of investments and strategies.

In summary, we believe that now is the prime time to reassess your asset allocations to capture a broad set of opportunities. Holding excessive cash comes with a significant opportunity cost. The broadening of global cyclical and rate tailwinds at the moment provide ample opportunities to put cash to work and achieve greater returns.

Investing for beginners

Choosing to invest for the first time can be confusing. Here, we'll cover the basics…

How to improve your financial future

From making the most of your money to reducing stress, planning ahead can help you achieve your goals. But it's often the last things on our minds.